Letter to Shareholders

Dear Shareholder,

Last year, global economies and the energy business continued to be challenged by the COVID-19 pandemic. However, a robust economic recovery drove energy demand and commodity prices higher, and underscored the importance of reliable, affordable energy in our lives.

Enbridge President and CEO Al Monaco, left, and Gregory L. Ebel, Chair, Board of Directors.

Enbridge President and CEO Al Monaco, left, and Gregory L. Ebel, Chair, Board of Directors.

Our people safely navigated COVID restrictions and supported each other and our communities. We continued to focus and deliver on our purpose—to provide the energy that people rely on every day to fuel their quality of life. We delivered record safety, operating and financial performance, and executed on key strategic priorities.

In 2021, Enbridge set employee and contractor safety and system reliability records because of our strong safety culture and investments in system integrity and preventative maintenance.

At the same time, we took steps to modernize our systems, diversify our assets, and advance our net-zero emissions and diversity and inclusion targets.

We’re proud of our people and what we achieved last year—helping to further cement Enbridge’s position as North America’s leading energy delivery company.

Delivering on results and strategic priorities

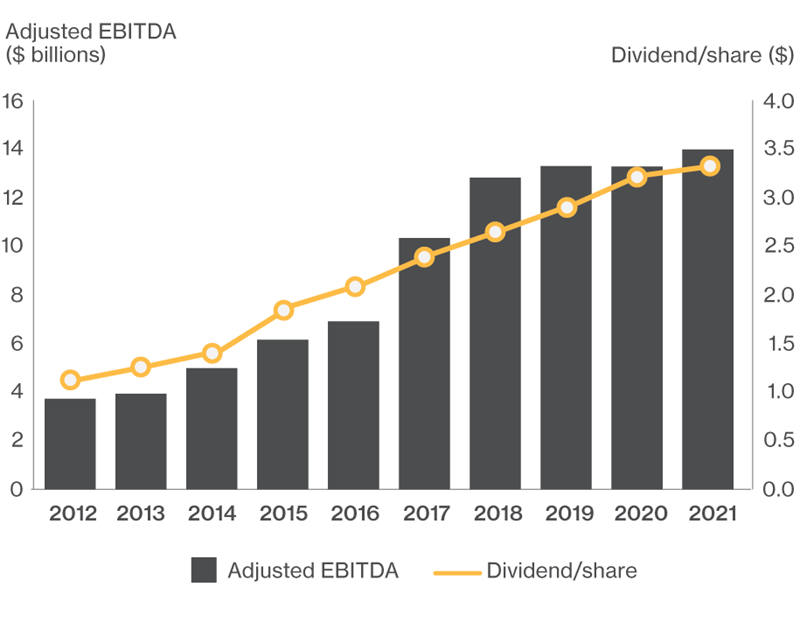

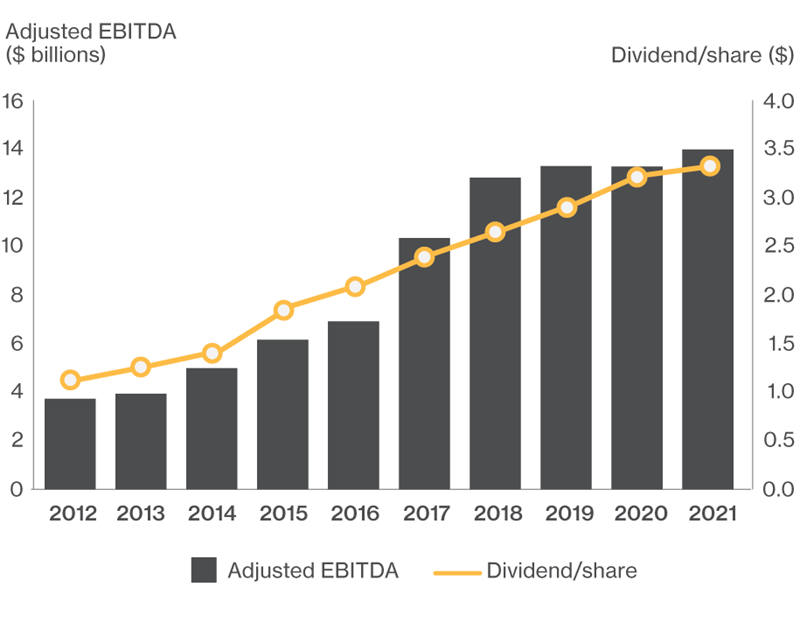

2021 was a catalyst year for the Company. We built on our momentum to grow our conventional business, reduce emissions intensity from our existing assets and expand our low-carbon investments. We reached the top end of our external guidance range for distributable cash flow (DCF)1 per share, increased our dividend for the 26th consecutive year—and extended that track record with another 3% dividend increase for 2022.

In 2021, we placed $10 billion of secured capital into service—including completion of the state-of-the-art Line 3 Replacement Project, the largest capital project in Enbridge’s history—and sanctioned $2 billion of new projects. These investments will contribute to cash flow growth and provide additional financial capacity in the years to come.

Engagement with Indigenous groups along the Line 3 right-of-way led to a better route, as well as tailored environmental measures to protect the land and minimize impacts. This engagement also resulted in $900 million in Indigenous business opportunities, including Indigenous workers comprising 7% of the U.S. Line 3 workforce. This valuable experience is being shared across our organization to further strengthen our lifecycle approach to Indigenous and stakeholder engagement.

Indigenous-owned MB Customs worked on the Line 3 Replacement Program in Minnesota.

Indigenous-owned MB Customs worked on the Line 3 Replacement Program in Minnesota.

We also advanced our export strategy with the acquisition of the Ingleside Energy Center, through which we established a leading light-oil export position and platform for future organic growth. We aligned that investment with our target to reach net-zero emissions by 2050 by committing to develop an on-site solar farm that will drive net-zero Scope 1 and 2 emissions, while also contributing to Scope 3 reductions. This is a great example of how Enbridge is differentiating its approach to energy infrastructure.

Good progress is being made on our $10-billion commercially secured growth program, including construction of four offshore wind projects in Europe, connecting new customers to our natural gas distribution system, and modernizing our long-haul pipeline systems. We also established industry partnerships to advance our early-mover position in renewable natural gas, hydrogen, and carbon capture and storage.

Over the past several years we’ve worked with our customers to develop a new contract offering for our Canadian Mainline. Last year, our proposal was declined by the Canada Energy Regulator (CER), despite having support from more than 75% of our shippers. We’ll continue to collaborate with our customers on two alternative options to assure a solid,

long-term commercial arrangement is in place.

1 Adjusted EBITDA and DCF per share are non-GAAP measures.

In 2021, Enbridge generated strong total shareholder returns of 30%. Over the past 10 years, we have grown earnings before interest taxes depreciation and amortization (adjusted EBITDA1) at an average annual rate of 14% by executing a $65-billion organic capital program, delivering on revenue and productivity improvements, as well as selective acquisitions that have advanced our strategies and driven further organic growth.

That includes the 2017 acquisition of Spectra, which transformed the business by adding a leading natural gas utility and pipeline footprint—complementing Enbridge’s irreplaceable crude oil assets and growing renewables business. Last year, Enbridge added North America’s leading crude oil export platform through the acquisition of the Ingleside Energy Center, which positions the Company to play a pivotal role in global energy exports. Our disciplined investment of capital, while protecting our sector-leading financial strength, has enabled us to grow the dividend on average by 13% per year over the past 10 years, supporting robust shareholder returns.

In February 2022, Enbridge and First Nation Capital Investment Partnership (FNCIP) announced plans to work together to advance a new carbon transportation and storage solution west of Edmonton called the Open Access Wabamun Carbon Hub. The proposed Wabamun Hub will tie into planned carbon capture projects, with the combined potential to abate nearly 4 million tonnes of CO2 emissions annually.

In February 2022, Enbridge and First Nation Capital Investment Partnership (FNCIP) announced plans to work together to advance a new carbon transportation and storage solution west of Edmonton called the Open Access Wabamun Carbon Hub. The proposed Wabamun Hub will tie into planned carbon capture projects, with the combined potential to abate nearly 4 million tonnes of CO2 emissions annually.

Bridging to a cleaner energy future

Forecasts show that the demand for energy will continue to increase as populations grow and developing nations raise their standards of living. Natural gas and oil make up more than half of that energy demand today and we expect demand to remain strong for decades to come, even as renewables grow. This energy is critical for transportation, heating, cooking, manufacturing, electronics, pharmaceuticals—and more. North America has an abundant supply of oil and gas with leading environmental performance—supply that can be exported to where it’s needed.

It’s clear that society is moving toward a lower-carbon economy. We believe that we need to transition our energy systems prudently to ensure adequate supply of conventional energy while lowering emissions and increasing investment in low-carbon energies.

Energy is needed in every aspect of daily life, and our assets provide an essential source of safe, reliable and affordable energy. Our systems have longevity because they serve the best markets and can’t be replaced. We’re modernizing our assets to improve efficiency and reduce emissions.

We have a solid inventory of both conventional and low-carbon opportunities, totaling about $6 billion of annual investment. On the conventional side, we’ll expand and modernize gas systems, which will displace coal and support renewables growth. We’ll continue to build out our LNG and export positions and invest in our gas utility. We’ll also pursue capital-efficient Liquids Pipelines optimizations.

These businesses also come with embedded low-carbon opportunities. Our existing assets will support the energy transition by blending and transporting renewable natural gas and hydrogen, transporting and storing carbon, and moving more natural gas. Our Renewables business also gives us high visibility to growth, with 14 projects in construction, including solar self-power in North America and offshore wind in France.

Getting the pace of the transition right will be critical. We’re taking a disciplined approach to ensure that new opportunities provide an attractive return, and we’ll build on proven technologies and partner with those who can bolster our capability. This is exactly the model we used for wind and solar 20 years ago, and today Enbridge has a leading renewables platform.

The Enbridge team continued to make a positive impact in our communities—including a US$4 million contribution to the United Way—and thousands of hours of volunteering with close to 3,000 local community and Indigenous organizations. Our people stepped up to support recovery efforts following wildfires and flooding in B.C., and the same care was shown after Hurricane Ida in Louisiana.

The Enbridge team continued to make a positive impact in our communities—including a US$4 million contribution to the United Way—and thousands of hours of volunteering with close to 3,000 local community and Indigenous organizations. Our people stepped up to support recovery efforts following wildfires and flooding in B.C., and the same care was shown after Hurricane Ida in Louisiana.

Sustaining our growth

In 2022, we’re positioned to grow adjusted EBITDA and DCF per share by about 8%. We expect to exit 2022 near the bottom of our 4.5x to 5.0x debt to EBITDA range, driven by annualized contributions from Line 3 and the Ingleside terminal. We remain focused on managing costs and maximizing our financial strength and flexibility.

Our visible cash flow growth outlook and healthy balance sheet will enable the return of capital as part of our shareholder value proposition.

Over the next three years, we expect to generate $5 to $6 billion of annual investment capacity. Of that amount, $3 to $4 billion will be prioritized to low-capital intensity and utility-like investments, and the remaining $2 billion will be deployed to the next best alternatives, such as organic growth, profitable energy transition investments, share repurchases or debt reduction. The $1.5 billion share-buyback program we recently introduced creates an additional avenue to return value to shareholders.

By executing on our secured capital program, enhancing returns on our existing businesses, and deploying excess financial capacity, we estimate 5 – 7% DCF per share compound annual growth through 2024 versus 2021 results.

Enbridge was an early investor in low-carbon energies and is well positioned to be a North American leader. In 2021, we established a dedicated New Energy Technologies team. Through 2025, we see opportunity to invest a further $1.5 billion to advance low-carbon opportunities, in addition to the $2.5 billion in offshore wind projects already in execution.

Being a differentiated service provider

Core to our strategy is our industry-leading approach to our environmental, social and governance (ESG) performance. Our performance in these areas has and will continue to differentiate Enbridge—setting us apart as the service provider of choice for our customers, an employer of choice, a trusted partner to communities, Indigenous groups and policy makers, and a best-in-class investment.

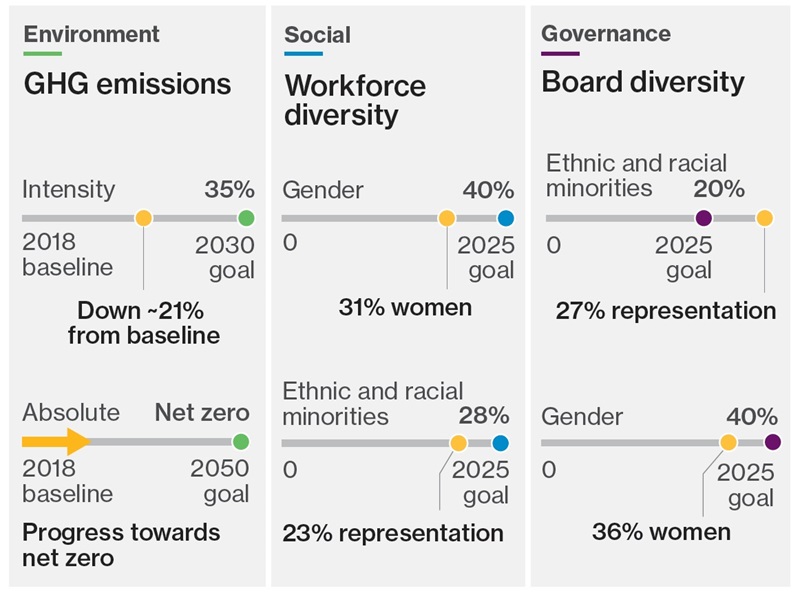

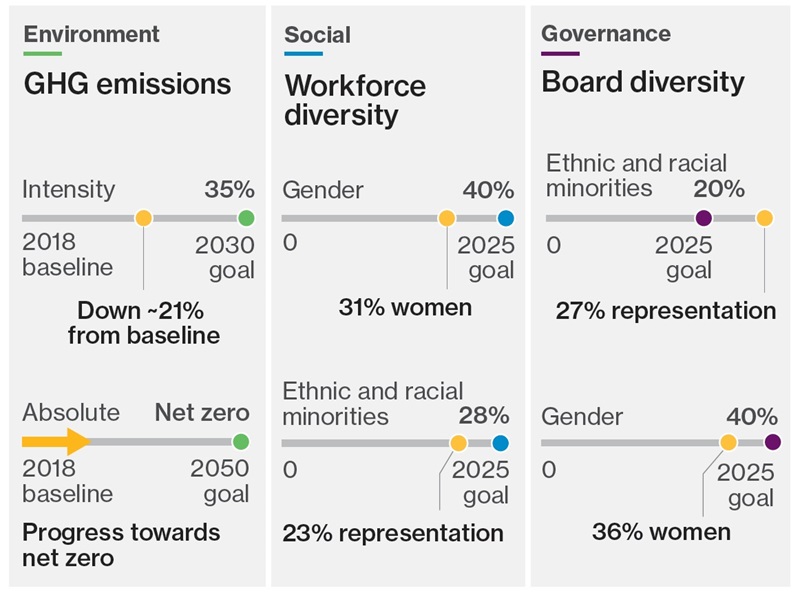

In 2020, we introduced ESG goals, including continuing to drive industry-leading safety performance, reducing emissions to net zero, and improving diversity and inclusion. We’ve set ambitious goals for our ESG efforts, made them public and linked discretionary pay for all employees to progress in these areas. At our inaugural ESG Forum in September 2021, we shared detailed plans for how we’re going about achieving these goals and how we’ve integrated them into each of our businesses.

2021 ESG performance update

Last year, we issued $3 billion in sustainability-linked financings that are tied to achievement of our ESG goals. We also further advanced our capital-allocation framework to ensure that all new investments account for carbon prices and are aligned with our emissions-reduction goals.

We’re on track to reduce our emissions intensity 35% by 2030 and reach our net-zero emissions target by 2050. Additionally, we expanded emissions reporting to include new Scope 3 metrics designed to measure the emissions intensity of energy delivered and the emissions avoided through our more than two decades of investment in renewables, low-carbon fuels, and demand-side management programs. Since 2018, we have reduced our emissions intensity and absolute emissions by approximately 21% and 14%, respectively.

Through demand-side management in our Gas Distribution and Storage business unit, we’ve reduced emissions by nearly 55 million tCO2e since 1995.

We’re committed to industry leadership in sustainability and continuous improvement in this area. That’s why we’ve implemented additional measures, including working with our supply chain to lower Scope 3 emissions, developing partnerships to advance low-carbon innovation within our businesses, and working proactively with organizations developing science-based guidelines for emissions targets in the midstream sector. This year’s annual sustainability report will include a scenario analysis that considers the resiliency of our strategy on a net-zero pathway.

We remain steadfast in our belief that an energized work force is driven by diversity, equity and inclusion. This continues to be a priority and has been embedded in our hiring decisions and training, including mandatory training on racial justice, unconscious bias and Indigenous cultural awareness.

Prior to the pandemic, we enhanced our Workplace Mental Health initiatives to provide more resources and education on well-being—programs that proved to be critically important over the last two years. We’re now advancing our efforts by raising awareness of the small actions we can take to reduce stigma, create personal well-being, and make people feel valued and appreciated.

We’re deliberate about creating the right environment for our people. We conduct regular surveys and focus groups to listen to their input and ensure that we continue to evolve and meet the needs of today. Last year, we expanded our FlexWork program to give Enbridge employees more choice to balance accountabilities at work and at home.

Our thanks

Each year our performance comes down to our people, who fulfill Enbridge’s purpose while living our values of Safety, Integrity, Respect and Inclusion. We thank them for their commitment to our business.

As we look to next year, the strong demand for our systems and execution on our capital program continue to drive stable and growing cash flows. We believe that our embedded conventional and low-carbon organic growth opportunities, along with our disciplined approach to investment and increasing dividends, provide a compelling growth outlook and continued strong value proposition for our shareholders and our other important stakeholders.

Sincerely,

Greg Ebel and Al Monaco

Gregory L. Ebel

Gregory L. Ebel

Chair, Board of Directors

Al Monaco

Al Monaco

President and Chief

Executive Officer

Calgary, Alberta

March 2, 2022