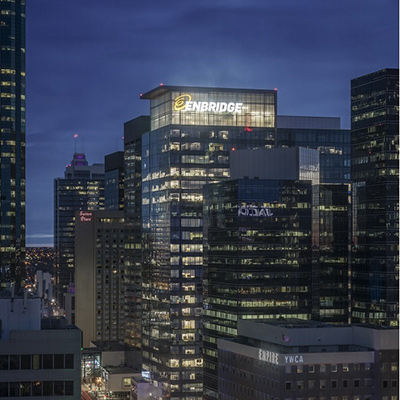

Why invest in Enbridge?

Our industry-leading, low-risk profile, our predictable cash flows, our disciplined growth plans, our sustainable and growing dividend, and our superior long-term shareholder returns.

For more information

Investor Dashboard

View our latest investor materials and filings by visiting the Investor Dashboard.

Learn more

Sustainability

To learn more about our sustainability practices, visit our Sustainability section.

Learn more